Wind energy development can potentially have environmental and economic benefits. Information about the potential benefits of wind power are listed below.

A 200 MW wind farm generates approximately $1,325,200 in property tax revenue annually. In a rural Nebraska county this would equal*:

- Approximately 39% increase in property tax revenue,

- Equivalent to approximately $6,626 per MW per year to the county,

- Of which, approximately $4,770 will be distributed to the local public schools.

Developing 1,000 MW of wind power in Nebraska**:

- Cumulative economic benefits: $1.1 billion,

- Annual CO2 Reductions: 4.1 million tons, and

- Annual Water Savings: 1,840 million gallons.

Increasing wind generation by 20% of the national electricity would benefit Nebraska by***:

- Creating ~3,100 long term jobs,

- Creating ~25,000 temporary jobs,

- Increasing property taxes revenues by ~$31 million annually, and

- Creating payments to landowners for leases of ~$21 million annually.

Grande Prairie Wind Farm

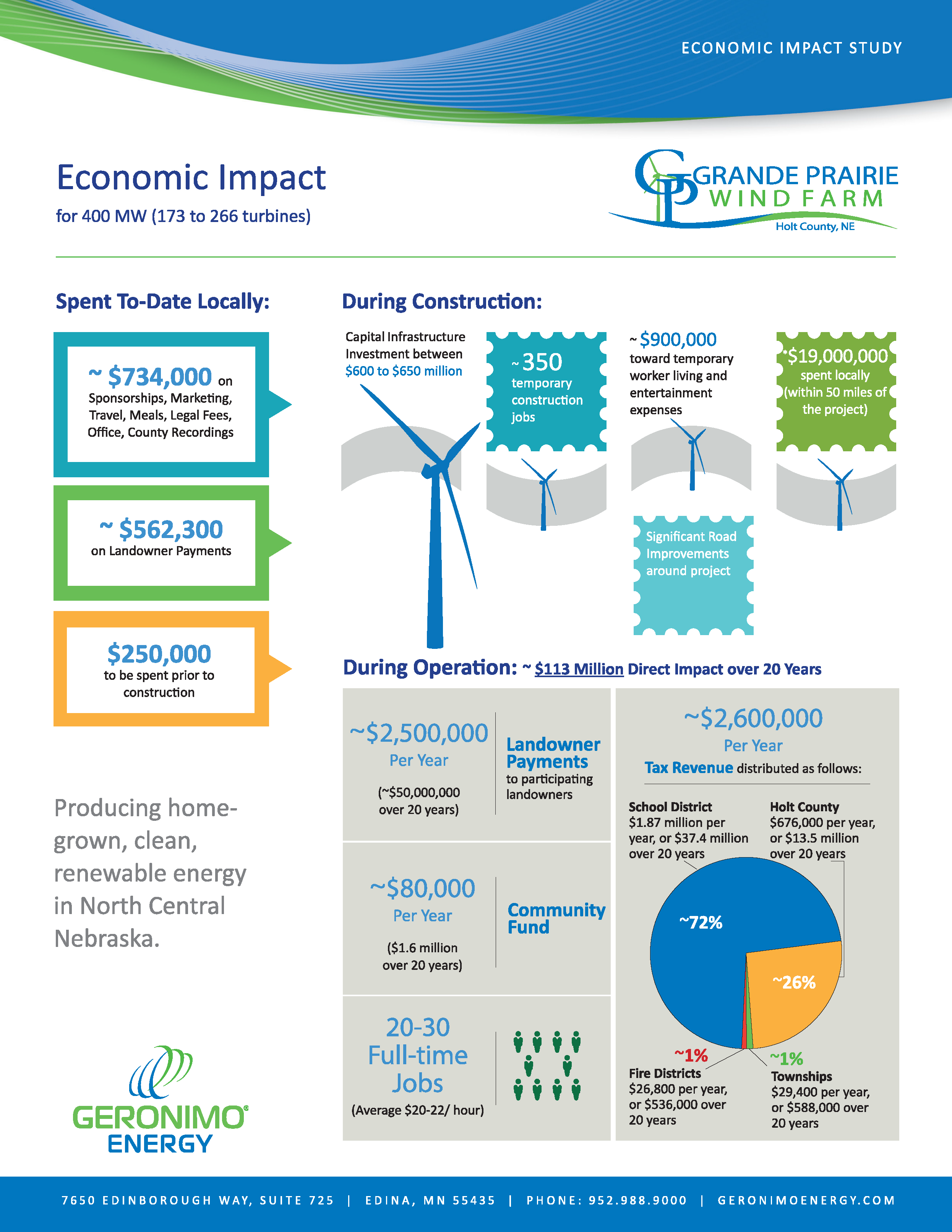

Geronimo Energy, LLC, the developer of a 400 MW wind farm under development in Holt County, Nebraska, compiled handouts identifying potential benefits.

- Economic Impact for 400 MW

- The Grande Prairie Community Fund is a 501(c)(3) organization, the purpose of which is to engage, assist, and contribute money (~$80,000/year) to support charitable activities.

Geronimo Energy Grande Prairie Wind Farm information available at: http://www.geronimoenergy.com/ourprojects/grandeprairie

References:

*Impact of Wind Energy on Property Taxes in Nebraska. Bluestem Energy Solutions & Baird Holm Attorneys at Law. 2013.

**Economic Benefits, Carbon Dioxide (CO2) Emissions Reductions, and Water Conservation Benefits from 1,000 Megawatts (MW) of New Wind Power in Nebraska. U.S. Department of Energy, Energy Efficiency and Renewable Energy. 2008.

***Renewable Energy and Economic Potential in Iowa, Kansas, Nebraska, South Dakota. Center for Rural Affairs. 2009.